Максимальная сумма сделки олимп трейд. Условия торговли. Общая информация о компании Олимп Трейд

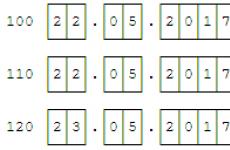

Опционы – это истекающие активы. То есть, когда вы покупаете или продаете опцион, вы делаете это на определенный срок. Поэтому, во время торговли на Олимп Трейд, сделки заключаются на определенное время. Минимальное время опциона – одна минута. В этой статье поговорим о возникающей ошибке Олимп Трейд длительность сделки больше максимальной.

Максимальный срок, на который вы можете купить опцион – это 3 часа. Разберемся, как регулировать время. Зайдите на торговый терминал, справа на экране у вас будет маленькое табло со временем.

Нажмите на эту табличку, и появится меню выбора времени опциона:

Как видим, на самом верху отображается максимальное время – 3 часа. А в самом низу есть пункт «свое время». С помощью него вы можете задать время опциона в 2 минуты или в 4 часа.

Даже если мы задаем время на одну минуту больше допустимого максимума, то есть, три часа и одна минута, платформа Олимп Трейд выводит нам ошибку длительность сделки больше максимальной.

Поэтому, если вы вдруг столкнулись с этой проблемой, проверьте табло, где задается время сделки. Возможно, вы по ошибке выставили время, превышающее допустимый максимум.

На опционах все сильно привязано ко времени. Здесь не получится, как на фондовой бирже или форексе, открыть сделку на целую неделю или месяц. Поэтому, на Олимп Трейд есть длительность сделки больше максимальной.

В противном случае, если время сделки у вас стоит не больше трех часов, а ошибка все равно возникает, нужно обратиться в службу технической поддержки для решения данной проблемы.

What is a trading platform?

It is a combination of hardware and software that allows users (traders) to make trades and provides them with access to information about financial markets.

Do I need to download any software to my PC to trade?

No, all you have to do is open an account on the OLYMPTRADE site

How do I view my trading history?

What time is displayed on the platform?

The time that is shown on the platform corresponds to the user time (according to your time zone).

Why doesn"t a trade open immediately?

It normally takes a few seconds to receive the data from the server, that is why a trade does not open immediately. Usually this process takes up to 4 seconds.

What do I do if there is a system error while I"m loading the platform?

If there are technical errors, first of all it is recommended that you clean up the cache and cookies in your browser. You should also check that the latest version of the installed browser is being used. If these actions and reloading the page are of no help and the error persists, please contact the technical support department.

What time of day is considered to be the most active trading time?

Currency trading activity depends on the operating hours of the main trading floors and increases when major economic news comes out. The most active trading sessions are the European and American ones, so, for example, the European session lasts from 06:00 am to 03:00 pm UTC. The US session lasts from 1:00 pm to 10:00 pm UTC.

Please note that trading in the currency pair USD / RUB takes place from 7:00 am to 05:00 pm UTC.

Is there a demo account?

We offer a demo account with 10,000 virtual units of your currency so that you can evaluate the benefits of our trading platform.

The minimum trade amount at OLYMPTRADE is $1 $ / €1 & (depending on your account currency).

What is the maximum trade amount?

The maximum trade amount is $2000 $ /€2000 (depending on your account currency).

The maximum trade amount for VIP clients is $5000 $ / €5000 & (depending on the account currency).

Are there any limits on positions?

The maximum trade per instrument for regular clients is $10,000 / €10,000 & (depending on the account currency).

The maximum trade per instrument for VIP clients is $10,000nbsp;/ €10,000 & (depending on the account currency).

The maximum trade amount on all trading assets for all users is $20,000 / €20,000 & (depending on the account currency).

What is a line chart?

This is a type of continuous chart which is based on the price feed. This chart represents the linear relationship between constantly changing quotes for exchange-traded assets. The chart is plotted online.

What is a candlestick chart?

This is a type of chart that uses Japanese candlesticks in its construction. It forms candlesticks on the basis of data for a certain time interval (time frame). For example, a candle with the 15-second time frame means that the candle body is formed over 15 seconds and a new candle starts after this period ends.

There are three types of candles:

- A green candle means that the price increased over the period.

- A red candle means that the price decreased over the period.

- An unformed candle means that the price has not changed over the period.

The candlestick chart is useful for technical analysis.

What are Heiken Ashi candles?

Heiken Ashi candles is an indicator that organizes the candlestick chart, smoothes out price fluctuations and makes the chart clearer and more informative. This is a useful and popular instrument among modern traders.

Heiken Ashi uses a special formula which contains:

- Heiken Ashi open level - the average value of the opening and closing prices of the previous standard candle (Close + Open)/2

- Close level - the average value of the high, low, opening and closing prices of the current candle (Min+Max+Open+Close)/4;

Therefore, the high is the highest value among the opening, closing and high prices of the current candle; the low is the lowest value among the opening, closing and low prices of the current candle.

Heiken Ashi comes in the following types:

- Green candle with no lower shadow - strong upward movement

- Green candle with a shadow - usually appears at the beginning or at the end of upward movement

- Candle with a small body and long shadows on both sides - indicates a possible trend reversal.

- Red candle - usually appears at the beginning or at the end of downward movement

- Red candle with no upper shadow - strong downward movement

The main disadvantage of the Heiken Ashi indicator is the lag behind the price chart.

What is a time frame?

It is a time scale of prices on the trading platform. If you choose a time frame of 10 minutes on the line chart, you can see the part of the price chart for the last 10 minutes. If you choose a "5 minute" time frame on the Japanese candlestick chart, each candle will show how the price changed over that this period (if it increased, the candle will be green; if it decreased, it will be red).

The following time intervals are used on the platform: 15 seconds, 1, 5, and 15 minutes.

What is zoom?

Zoom is an is an additional chart feature that helps you use a greater amount of historical data within 24 hours. This feature allows a trader to scroll through the history of the chart for a certain time back, zoom in and out from certain chart segments. Zoom scrolling is necessary for technical analysis, the goal of which is to find patterns in a historical period of a chart. At OLYMP TRADE zoom is beneath the quotes chart.

What are options and how do I trade with them?

A option is a stock market tool for earning money by forecasting whether the the price of an asset will go up or down. A traders can earn money even if the price has only changed by 1 point. For more information please see the "How to start " section.

How do I start trading?

Right after the registration is completed, a trading account is opened automatically, and you can make a deposit. At OLYMPTRADE the minimum trade amount is $1 / €1, and the minimal deposit is $10 / €10.

Options are a tool that is simple enough for beginners.

The trading algorithm consists of just a few steps:

- Choose an asset.

At OLYMP TRADE you have access to the following assets: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/RUB, AUD/USD, EURRUB, USD CAD, EUR JPY, EUR CHF, Bitcoin, Apple, Boeing, Facebook, Google, IBM, Tesla, Coca-Cola, McDonald\"s, Microsoft, Visa, Starbucks, COMMODITIES, silver, gold, BRENT, DAX, S&P 500, NASDAQ, Dow Jones, AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, CAD/CHF, CAD/JPY, СHF/JPY, EUR/AUD, EUR/CAD, EUR/GBP, EUR/NZD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD, USD/SGD, USD/MXN, USD/NOK, USD/CLP, natural gas (NG), copper, platinum, the CAC 40, EURO STOXX 50, Hang Seng Index, Nikkei 225, RUSSELL 2000, FTSE 100, BMW, Nintendo. - Decide how much to invest.

Your payout will vary depending on your investment. If you open an option successfully, your profit will be as high as 100%. Your profit depends directly on market volatility. The higher the volatility, the higher your profit. - Set the time after which your prediction will prove correct (execution time).

At OLYMPTRADE you have time ranges from a minute to 3 hours. - Decide whether the asset price will go up or own and press either on the Up button (if you think that the price will go up), or on the Down button if you think that the price will go down).

- Wait for the trade to expire.

How can I delete my account?

The account can only be blocked. To block your account, you need to contact the clients support department at or you can call us: +357 22007136

What is market volatility?

Volatility is the variability Volatility – instability, variability in a price on an exchange over a specific period of time. In other words: it is a statistical financial indicator of the variability of the price. For traders it is a very important indicator, because, when selecting an asset, one needs to know what fluctuations it is subject to. The volatility figure makes it possible to assess the risk of investing in a particular asset. The higher the volatility, the higher the risk. At the same time, the volatility figure also makes it possible for a trader to estimate potential profit.

What is the the option execution time (expiration time)?

This is the time period, at the end of which a trade is closed automatically, i.e., is executed. At OLYMPTRADE you can choose time ranges from 1 minute to 3 hours.

Please note that you can cancel a trade on your own. If you realize that your forecast is incorrect and the chart is moving in the wrong direction after a trade has executed, you can cancel your trade and avoid the total loss of your investment. In the "My Trades" section (in the Sell column) you can see the refund amount if a trade is canceled (you can get back up to 120% of the investment depending on when the trade is canceled). If you want to cancel a trade, you need to click on the button with the return amount and then confirm the early sale.

What are assets?

Assets include currency pairs, stocks, indices, and commodities. These underlying assets are the foundation of any option. When you trade options, you can trade currency pairs, commodities (gold, oil), key stock exchange indices and stocks. You can review the complete list of assets and the trading time for each of them in the corresponding section of our site Assets ».

How can I close a trade early?

At the Olymp Trade platform you can close a trade before the option expiry time. The refund depends on the change in asset price. The more actively the price chart moves in the trade direction you selected, the larger the refund when the option is sold. If the price chart moves against your prediction, the refund amount may fall to zero. The maximum refund may be up to 120% of the investment. Up to 100% for cryptocurrency assets. By selling the trade, you can get up to 20% net profit without waiting for expiry time. The sell trade functions will become inactive if less than 1/6 of the time is left until expiry.

What is asset liquidity?

Liquidity is the capacity of an asset to be sold quickly with minimum monetary losses related to the speed of the sale. In other words liquid means convertible into money. Currencies are the most liquid asset. Second in liquidity are gilt-edged securities. On the securities market, liquidity directly depends on the trading volume for an asset and on the number of current buy and sell offers. Precious metals rank third. Metals such as gold, silver, platinum and palladium are exchanged-traded commodities. Their price is determined at the centers of global trade, in New York and London. Bars of these metals can potentially be sold at any time and with minimal losses.

The more liquid the asset has, the less risky it is for the investor.

What are call and put options?

A call option is bought if a trader believes that the the price of the chosen asset when the option is exercised will be higher than at when it was purchased.

A put option is bought when a trader believes that the price of the chosen asset when the option is exercised will be lower than when it was purchased.

You can find out the meanings of other important option terms in the section "Terms ".

What is a trading system?

It is a system of several components that helps a trader decide whether to open a trade. The system includes one or more analysis tools (fundamental, technical, graphical analysis), the specific conditions for their use, the rules of money management and psychological attitudes. Trading Strategy - an algorithm using indicators and other analytical tools and a set of specific rules for executing trades with them. A trading strategy is part of a trading system.

Do I lose my deposit if the purchase price matches the fulfillment price?

The deposit is not lost; in this case the cost of the option is returned to the trader.

What is a risk-free trade?

Example: the risk-free trade limit is $100. It means that after its activation, you can open a trade for no more that 100 USD. If your prediction is wrong, we will return up to 100 USD to your trading account.

You can activate a trade amount less than risk-free trade limit. Example: the risk-free trade limit is $100. You have activated the risk-free trade, but entered 80 USD as the "trade amount." If your prediction is wrong, we will return 80 USD to your account. However, the difference between the risk-free trade limit and the chosen trade amount will not be returned.

Do I need any training before getting started?

General knowledge and access to economic news are sufficient for the novice trader. You can review the principles of option trading by studying our section " " and joining our ".

How do traders make money on the Forex market?

Forex traders make money on the difference in exchange rates for currencies and other assets. For example, a trader believes that the EUR/USD exchange rate will go from 1.11000 to 1.12000. He makes an up trade for a certain amount. If the prediction is correct, the trade makes a profit. Another example: a trader believes that the value of the US dollar will fall against the Japanese yen. In this case he can open a down trade and, if the USD/JPY exchange rate falls, the trade will likewise make a profit. The amount of profit will depend on the amount invested, the multiplier used, and how far the price falls or rises.

How does the Forex market differ from the options market?

On the Forex market, profit depends on the trade amount and how much the price increases or decreases. Also, the trader himself decides when to close a current trade.

Trading options, a trader has to predict the direction of the price and the time frame for which the prediction is valid. The amount of profit is fixed: the trader cannot make more than the amount set when the trade was opened.

What is the main advantage of the Forex market?

On the currency market, a trader can make trades for amounts far exceeding the amount of the funds on his trading account. He can do this thanks to a special trading tool, the multiplier. Using a multiplier, a trader makes a trade 50/100/150/200 times the trade amount he enters (security). Let"s assume that two traders decide to make an up trade on the EUR/USD pair from 1.11000 at the same time. The first trader invests $100 in the trade but does not use a multiplier. The second trader also invests $100 but uses a multiplier of 200. The EUR/USD chart goes to 1.12000 and both traders close their trades. The first trader"s income will be about $1. The second trader"s profit will equal $200. Using a multiplier helps increase the rate of return but may also increase a loss.

Can I select the trade amount myself?

Yes, the minimum trade is $1/1 euro/100 rubles. The maximum trade amount is $2,000.

How many trades can I open at the same time?

No more than 10 trades per asset are allowed.

How does Olymp Trade make money?

What trading styles are used on Forex?

There are three popular trading styles:

- Intraday trading or scalping: all transactions are carried out within a day. Traders try not to roll open trades over night. It is the most popular style because it allows for making many trades during a trading session with a small, but steady profit. Successful scalpers enjoy a steady income.

- Medium-term style. Traders applying this style spend more time analyzing market trends, trying to pick the time to open a trade as precisely as possible. As a rule, trades are made for a period from two-three days to a week. Traders try not to roll trades over a weekend to protect their money as much as possible from force majeure and political events that might adversely affect the trade outcome.

- Long-term style. The main goal of a trader applying this style is high long-term profit. Traders are ready to wait a long time to implement an investment idea. It is suitable for users with a lot of capital.

How can I protect the income on a current trade and limit my loss?

To safeguard your money or lock in income on an open trade, we recommended using the automated "take profit" and "stop loss" services. When the profit set in the Take Profit parameter is reached, it is automatically locked in. If the loss indicated in the Stop Loss is reached, the trade is automatically closed.

These services are triggered even if the trader is not on the platform.

At what time can I trade on Forex?

Forex comprises numerous platforms worldwide, so trading goes 24 hours a day from Monday through Friday. Auctions open on Monday at 9:00 pm GMT and close at 9:00 pm GMT on Friday.

Can it happen that I would owe the company something?

No, this situation is impossible. The loss on a trade will not exceed the trade amount entered by the trader. If the trader uses a stop loss, the loss will be based on the closure of the trade at the current market price when the stop loss triggered, but the maximum loss cannot exceed the trade amount.

Stop loss and Take profit

Take profit automatically closes the trade at the profit level you have indicated in advance. Stop loss automatically closes the trade at the loss level you set and protects the entire amount of the trade.

Stop loss and Take profit settings help to close trades in time without monitoring them on the platform.

To set Stop loss and Take profit, when the trade is made, install this feature in your dashboard .

Multiplier

The main advantage of the Forex market is the multiplier. It increases the trade amount, and therefore your potential profit, tenfold. The size of the multiplier depends on the asset and can be 50, 100, 200, or 500.

The multiplier only affects the amount of the trade. The maximum loss is limited to the trade amount.

Edit the multiplier on your own and as you wish. To do this, activate this setting in your dashboard .

Commission

There are two types of commissions on Olymp Trade Forex and their size depends on the trading asset and the market situation:

- trading commission;

- overnight commission.

It is a standard practice of any broker to debit commissions. Brokers set commission rates at their own discretion.

Trading commission:

You can see it when the trade is made. The commission rate depends on the multiplier you choose.

- You`ve selected a multiplier of 500.

- The trade amount is $100.

- This means that the total trade amount is $50,000.

- The trading commission rate is 0.024%.

- 0.024% of $50,000 is $12.

- The trading commission for opening a $100 trade is 12%.

The greater the multiplier, the greater the opportunity to earn profit. However, the commission rate in this case will be greater because you use the broker`s funds in the trade. The maximum commission with a multiplier of 500 is 15%; with other multipliers - 7.5%.

The overnight commission is debited at 9:00 pm UTC on work days. Its rate does not exceed 15% of the trade amount with a multiplier of 500 and 7.5% with other multipliers.

The commission is not debited on the weekends.

Why do you have one opening quote?

We have simplified commissions for opening trades. We include the amount that other brokers include in the spread in the trading commission.

In the Forex market, the spread is formed not only by the market conditions, but also by a broker, since the spread premium is one of the types of the broker`s hidden commission.

We decided to make the commission more convenient: you do not need to calculate anything. You see the trading commission in advance.

Do you have SWAPs?

The rollover in the Forex market is carried out by market swaps, which can be both negative or positive, depending on the difference in the interest rates.

We do not have swaps, but there is a daily commission, the rate of which you can view on the Tools specification page.

The overnnight commission is debited at 9:00 pm UTC on work days and does not exceed 15% of the trade amount. Usually it is significantly less than 15%.

We decided not to use swaps to make it more convenient for you to predict the overnight commission amount and quickly make a decision to close a trade or roll it over.

Stop out, why did the trade close automatically?

We have limited the loss amount to the trade amount, so that clients do not lose the entire deposit due to an accidental error. This will help you to control the situation, withstand emotions, and lock in the loss promptly. If your forecast is wrong, the trade will close automatically once your loss equals the trade amount.

Can I open the trade beforehand?

In order to open a trade at a specific time or at a certain quote level, open a trade request. You can do this in the Requests section under the chart.

How do I make a forecast?

You can use one of the two methods or use both at once.

Technical analysis is a method of analyzing the market, based on the change patterns in the asset price in the past and present. In order to determine a trend, several methods of technical analysis can be used: chart, candlestick, indicator.

Chart analysis is the analysis of the chart patterns that are used to determine the trade movement and reversal. Candlestick analysis is the analysis of Japanese candles and their combinations that signal a reversal or trend continuation.

Indicator analysis is done using indicators and oscillators. The indicators are based on mathematical calculations and help to determine the price movement. You can learn how to use the indicators in the Education and Assistant sections.

Fundamental analysis is based on studying financial and economic country conditions, stocks, or industries. Traders study forecasts, news, reports, and ratings to determine the price movement of an asset. You can view important news in the Economic calendar .

How do I calculate my profit?

Your profit from a trade can be up to 100% of the invested amount. Your profit directly depends on the return percentage. The higher the return rate, the higher your profit.

The return rate depend on several factors:

- The market environment (volatility, liquidity)

- Balance within the company. The automatic risk algorithm determines the number of opened buy and sell trades for each asset. The number of sellers and buyers is usually balanced. If one side is overweighted, the company cuts the profitability for the out-of-balance asset to cover the costs. But in any case, the profit from successful trades is paid to clients in full.

What is the minimum deposit amount?

The minimum deposit amount is $10 / €10 &.

Is there a commission for servicing the account?

If, within 180 days, the client does not make any trading operations (transactions) on their real account and/or has no non-trading operations of replenishment/withdrawal of funds, a service commission (subscription fee) in the amount of $10 (ten dollars) or the equivalent of this amount in the account currency will be debited from their account monthly. The rule is set forth in clause 3.5 of the Non-trading Transaction Policy and the KYC/AML Policy.

If there is no amount in the client"s balance enough to pay for the service, the commission amount becomes equal to the account balance, and the available bonus funds and risk-free trades are canceled. If the client has a zero balance, the commission will not be debited and the debt to the company will not arise.

If the trader has several accounts without activity for six months or more, the subscription fee will be charged only from one of them. The right to choose the account for debiting belongs to the company. The commission will be charged until the resumption of activity of the client, namely before the first trading or non-trading operation on a real account.

To avoid charging a subscription fee to the client, it is necessary to open at least one trading operation (transaction) on a real account or to make a non-trading operation (deposit/withdrawal) within 180 days.

The history of subscription fees for debiting is available in the Trades section of the personal account.

What is the minimum trade amount?

The minimum trade amount on our trading platform is $1 / €1 .

Is there any fee for depositing or withdrawing funds?

No, OLYMPTRADE assumes all commissions.

How do I make a deposit?

In order to make a deposit to your account, you need to choose the «Deposit » section in your Dashboard, choose the payment method, fill in the deposit amount (the minimum is $10 / €10), and then click on the Deposit button. You will be offered a deposit bonus. If you do not wish to receive this bonus, you should click on the "Cancel bonus" button and follow the instructions.

Deposit methods

Can I use my bank card to make deposits?

Yes, with OLYMPTRADE you can make a deposit using a bank card.

How can I withdraw funds?

In order to withdraw funds, you need to submit a request in your Dashboard. Go to the "Withdrawal " section, select the withdrawal method, fill in the amount and click "Submit request".

The maximum withdrawal period is 5 business days, but we always try to process your requests as fast as possible. Usually, 90% of requests are processed within 24 hours or on the next business day.

Withdrawal methods

What is the minimum withdrawal amount?

The minimum withdrawal amount is $10 / €10 depending on the currency of your account.

Do I need to be verified?

Verification is available upon request. If you need to pass the verification, you will receive an e-mail indicating this during registration. As a rule, the following documents are requested to verify a client:

- A color copy (scan/photo) of the passport page spread or ID card.

- Your selfie with the document (passport or ID) in expanded form. Face and document data should be clearly visible on the photo.

- Proof of residence.

- Confirmation of means of payment used on the trading account.

Where should I send the documents?

You will be able to upload your documents from your profile page. The section for uploading documents opens after receiving your request for verification.

How long does verification take?

Processing of the documents sent by the Client takes up to five business days.

How can I find out result of document verification?

After the verification is completed, you will receive a notification on the platform and via email.

Компания Olymp Trade является одним из самых популярных брокеров бинарных опционов в России и СНГ. Это крупная организация с отличными торговыми условиями и фирменной торговой платформой, по праву считающейся одной из лучших на рынке.

Давайте перейдем к сути вопроса. Минимальная ставка в Олимп Трейд для рублевого депозита составляет 30 руб., а для валютного $1 (или 1 евро).

Учитывая нынешний курс российского рубля, открывать счета в российской национальной валюте предпочтительнее, если у Вас относительно небольшой капитал. В этом случае Вы получаете возможность работать с "недорогими" бинарными опционами от 30 руб.

Что касается максимальной ставки в Олимп Трейд, то она составляет 150.000 р. для стандартных счетов и 400.000 р. для VIP-клиентов.

Работа с минимальной ставкой у брокера Олимп Трейд

Многие новички стараются приступить к торгам "бинарами" с небольшой денежной суммы. Как правило, этих средств не хватает для комфортной торговли и поддержания умеренных рисков.

В таких ситуациях на помощь приходит бонус от брокера в размере 100% к сумме пополнения депозита. Главные особенности такого бонуса:

- Его не нужно отрабатывать;

- Он не исчезает во время торгов;

- Бонус не влияет на вывод средств со счета;

- Сам бонус нельзя снять, но его можно использовать в торгах, как свои собственные деньги, что очень удобно.

Получить его можно при пополнении депозита на суммы от 2 т.р. Таким образом, пополняя свой новый торговый счет даже на 2000 р., в Вашем распоряжении окажется 4 т.р.! Этой суммы уже вполне достаточно, чтобы комфортно использовать в торговле даже не минимальные ставки у Олимп Трейд.

Как получить бонус?

Бонус в размере 100% от суммы пополнения депозита начисляется при регистрации нового счета. Если у Вас уже есть счет в компании, то снимите с него деньги, а потом напишите в чат поддержки, что хотели бы закрыть данный аккаунт по той или иной причине.

Например, Вы можете не хотеть продолжать торговлю в ближайшее время или же планируете в ближайшем будущем перейти на работу с депозитом в другой валюте. Главное, чтобы Вам просто заблокировали старый аккаунт.

Теперь нужно зарегистрировать новый счет через акционную страницу, чтобы сайт брокера воспринял Вас как нового пользователя, а то бонус не будет предложен после регистрации.

Я нашел видео, в котором подробно рассказывается, как это сделать в любом из популярных браузеров. Рекомендую посмотреть!

По моему опыту, а так же опыту уже нескольких сотен коллег, получавших такой бонус, можно указывать прежние ФИО, номер телефона и платежные реквизиты, но необходимо будет использовать другую электронную почту.

После регистрации бонус +100% будет доступен в течение 60 минут для сумм: 2 т.р., 5 т.р., 10 т.р. Нужен такой же по величине бонус, но на большую сумму денег? Тогда читайте далее, как это сделать!

Движемся к максимальным ставкам в Олимп Трейд

Если Вы планируете открыть новый счет с бонусом +100% к сумме, превышающей 10.000 р., то действуйте тем же образом, что был описан выше, но не спешите пополнять депозит.

После регистрации пополняйте баланс на 350 рублей без бонуса. Теперь нужно заключить несколько сделок, причем так, чтобы потерять всю сумму. Как только баланс обнулится, в разделе пополнения баланса появится новая акция "+100% к любой сумме".

Теперь в течение 60 минут можно заводить на депозит любую сумму для получение +100%. К примеру, если Вы пополните торговый счет на 50 т.р., то Вам сразу зачислится еще 50 бонусных т.р. от Olymp Trade.

Такого капитала вполне хватит, чтобы забыть о минимальных ставках в компании Олимп Трейд и начать зарабатывать действительно крупные суммы денег.

Даже если Ваш депозит позволяет заключать сделки на средние и крупные суммы денег, все равно начинайте торги минимальных ставок. Это позволит привыкнуть к трейдингу на реале и безболезненно освоиться с мыслью, что Вы приступаете к торгам всерьез.

Несмотря на то, что на платформе Олимп Трейд безрисковые сделки работают уже достаточно давно, мало кто понимает, в чем заключается их суть, и какую выгоду можно получить в конечном итоге. Поэтому перед тем как начать пользоваться этой опцией, необходимо разобраться в ее сути.

Что это такое?

И действительно, что значит безрисковые сделки на Олимп Трейд? Работа представленной опции стала возможной благодаря желанию брокера обезопасить трейдеров без опыта работы на рынке. Это, по мнению руководства площадки, должно способствовать повышению уровня доверия к брокеру и избежать распространения мнения касательно того, что опционы - это обычный развод.

Что необходимо для заключения безрисковой сделки?

Опираясь на торговые условия Олимп Трейд, сделки без риска способны заключать только те пользователи, которые ранее успешно оформили ВИП-статус. Сначала для этого требуется регистрация нового аккаунта (если он уже есть, регистрироваться заново не нужно). Процедура является достаточно простой, отнимает минимальное количество времени. Как только регистрация будет завершена, клиент получает полный доступ к терминалу. Получить ВИП-статус можно в автоматическом режиме, пополнив свой счет.

Обратите внимание! В соответствии с требованиями компании, для получения ВИП-статуса минимальная сумма депозита должна составлять 100 000 рублей (2000 долларов).

Минимальная сделка на Олимп Трейд

Минимальная сумма сделки составляет 5 тысяч рублей.

Максимальная сумма сделки Олимп Трейд

В соответствии с требованиями системы, максимальная сумма беспроигрышной ставки составляет не более 400 тысяч рублей.

Длительность сделки больше максимальной

Чтобы в конечном итоге не получить сообщение длительность сделки больше максимальной на Олимп Трейд, необходимо почитать в правилах максимальную длительность совершения сделок. Количество безрисковых сделок отображается напрямую в терминале. Таким образом, появляется возможность подобрать оптимальный вариант для их использования.

Всегда помните о следующем - возможность применения безрисковых сделок не делает торговлю гораздо более стабильной. Задача этого инструмента заключается в повышении результативности ведения торгов в случае, если пользователь научится правильно их применять на практике.

Получив определенное количество ордеров, использовать их бездумно не стоит. Грамотный подход повысит шансы на получение первого дохода от открытия позиции по новостному сообщению. Даже новички знают, что появление новостей способно в той или иной степени сказываться на рыночных колебаниях. Для этого надо будет обязательно обратить внимание на экономический календарь.

Основная его задача заключается в получении информации касательно даты публикации новостных сообщений, а также определении ее степени важности. Сначала следует пользоваться только самыми важными новостными сообщениями, отмеченными тремя значками в экономическом календаре. Причина заключается в том, что подобные новости способствуют появлению наиболее бурной реакции на рынке. Далее можно делать на Олимп Трейд сделки по скальпингу, если есть достаточный запас опыта.

Выводы

Безрисковые сделки являют собой специализированный инструмент, задача которого заключается в уменьшении вероятности проиграть деньги, совершая те или иные операции. Это не инструмент для постоянного извлечения дохода, потому что количество доступных сделок ограничивается системой. Это, скорее, возможность учиться работать с реальными средствами на практике, не боясь за их сохранность.